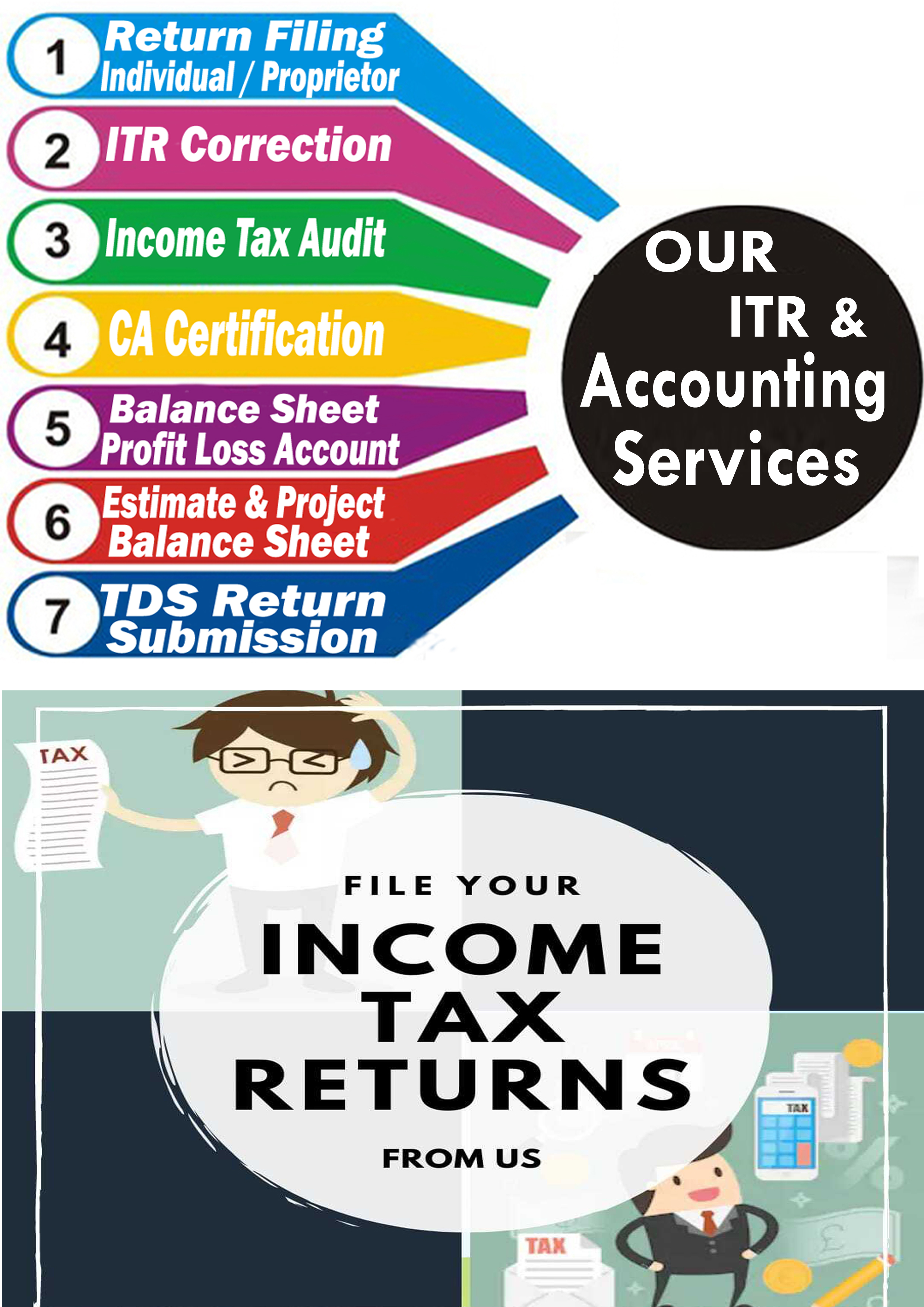

Filing Income Tax Returns (ITR) and managing taxes can often be a complex and time-consuming process. Our ITR and Tax Consultancy services are designed to simplify your tax-related responsibilities, ensuring compliance with legal requirements while optimizing your financial planning. With our expert assistance, you can stay on top of your taxes and achieve greater financial peace of mind.

Our team of experienced professionals offers personalized tax solutions tailored to your specific needs. From understanding your income sources and applicable deductions to calculating your tax liabilities, we provide end-to-end guidance. We ensure that your ITR is filed accurately and on time, helping you avoid penalties and legal complications.

Beyond filing returns, we assist in tax planning to help you make the most of available exemptions and deductions under the Income Tax Act, 1961. Whether you are an individual, a freelancer, or a business owner, our consultancy services include advice on saving taxes, optimizing investments, and planning for long-term financial goals. We also handle complex cases involving multiple income sources, foreign income, and capital gains.

To streamline the process, we offer an easy-to-use platform for document submission, income declaration, and real-time status tracking of your ITR. Our system ensures data confidentiality and security, giving you the confidence to manage your taxes effortlessly. With transparent pricing and no hidden charges, our services provide excellent value for money.

Take the stress out of tax management with our reliable ITR and Tax Consultancy services. From basic filing to advanced tax advisory, we are committed to simplifying your tax journey and maximizing your financial benefits.

Income Tax* is a Direct Tax paid to the Government of India based on the different sources of income. It is paid for by all residents and Non-Resident Indians. The exact value of the Income Tax is calculated based on various factors. Deductions and tax slabs are the most prominent factors that require special mention. Let us discuss the method to calculate the income tax based on the tax slab in detail here.

As per the rules and regulations stated by the Income Tax Department of India, an individual is allowed, at all points of time, to have 5 sources namely:

Easy Loan Approval :: The bank or private financers require numerous documents while processing the loan application request. The loan application may be for the purchase of vehicles (2-wheelers or 4-wheelers), home loans or personal loans for some commitments etc. Before they sanction, ascertaining the capability to pay-off the loan is very much necessary, it will be done based on your income earnings, income tax return acts as proof of your consistent income earning over the past periods. This is a mandatory document for loan approval.

Claim Tax Refund :: Tax can be deducted from your interest on Fixed Deposits, Rental income, Consultancy income or Salary income. There may be instances where tax has been deducted (TDS) is more than the tax due on your total income or you have no tax liability for that year. In such cases, you must file an Income Tax Return to claim a refund of the TDS.

Income & Address Proof :: Your Income Tax Return can serve as proof of your income and address. Aadhar Cards, licenses, passports, and other documents like those are all required to have address proofs.

Quick Visa Processing :: When applying for a visa, most embassies and consultants require copies of your tax returns from the past couple of years. These documents are among the mandatory requirements as they illustrate the person's civic responsibility. Therefore, it is advisable to file your ITR in a timely manner.

Carry Forward Your Losses :: One might have losses from the stock market, by doing business, loss from rental income of house property. These losses can be offset against the income of future years, thereby reducing your tax liability. Only by filing your return within the original due date, you can carry forward losses to subsequent years. Without filing an income tax return, this benefit would not be possible.

Obtaining Government Tenders :: For contractors, these returns must be filed on time, extremely accurately, and audited (if necessary). This is especially essential when trying to obtain a government tender. The tender scrutiny committee may occasionally inspect this work, and it is a common practice to check the ITR for the last 3 to 5 years.

For Buying Term Insurance :: To approve term insurance plans, insurance providers often require applicants to submit their Income Tax Return (ITR) records as proof of their annual income. The coverage amount is determined based on the individual's earnings, and presenting the ITR helps insurance providers assess a person's higher income level.

Funding for Startup Ventures :: When planning to launch a new company or grow an existing one, you might require funding from outside sources like venture capitalists or seed investors. These investors might inquire about the specifics of your ITR in order to evaluate the business's financial stability and profitability. They could cross-check the data in the audited report using your ITR forms as well.

Avoid Penalty and Punishment :: The taxes that apply to you are governed by the Income Tax Act 1961. Thus, you are required to pay taxes if you fall above the exempt criteria.

So, if you are eligible to pay taxes on your income and yet still fail to file your Income Tax Returns, then you attract charges.

The income tax officer can levy a penalty of up to Rs 5000 Rs. Other serious punishments can also occur if you do not file returns.

Thus, you should file ITR to be safe from such penalties and punishments.

DISCLAIMER -

Tax-related services and advice are provided in accordance with the prevailing tax laws and regulations. The information provided is general in nature and does not constitute legal or financial advice. Clients are advised to consult with a professional tax advisor for personalized guidance based on their specific financial situation. While every effort is made to ensure accuracy, we are not responsible for any errors or omissions in the tax filing process or the interpretation of tax laws. The client is solely responsible for providing accurate and complete information required for tax filing.